Are We Passing the Israel Test? George Gilder Appears on The Bill Walton Show

Entrepreneurs Create Abundance. Bureaucrats Create Scarcity.

The Abundance of Air Travel Since 1970

Who Is Creating More Value For Society? Jeff Bezos or Bernie Sanders?

Michael R. Strain of the American Enterprise Institute has noted: Billionaire innovators create enormous value for society. In a 2004 paper, the Nobel laureate economist William D. Nordhaus found “that only a minuscule fraction” – about 2.2% – “of the social returns from technological advances” accrued to innovators themselves. The rest of the benefits (which is to say, almost all of them) went to consumers. If Amazon founder Jeff Bezos is worth $170 billion, then according to Nordhaus, he’s created over $7.7 trillion in value for society. Bezos has made each American around $23,000 richer. But Vermont Senator Bernie Sanders thinks an innovator’s 2.2 percent is too much. Sanders tweeted “Billionaires should not exist.” Continue reading on Substack.

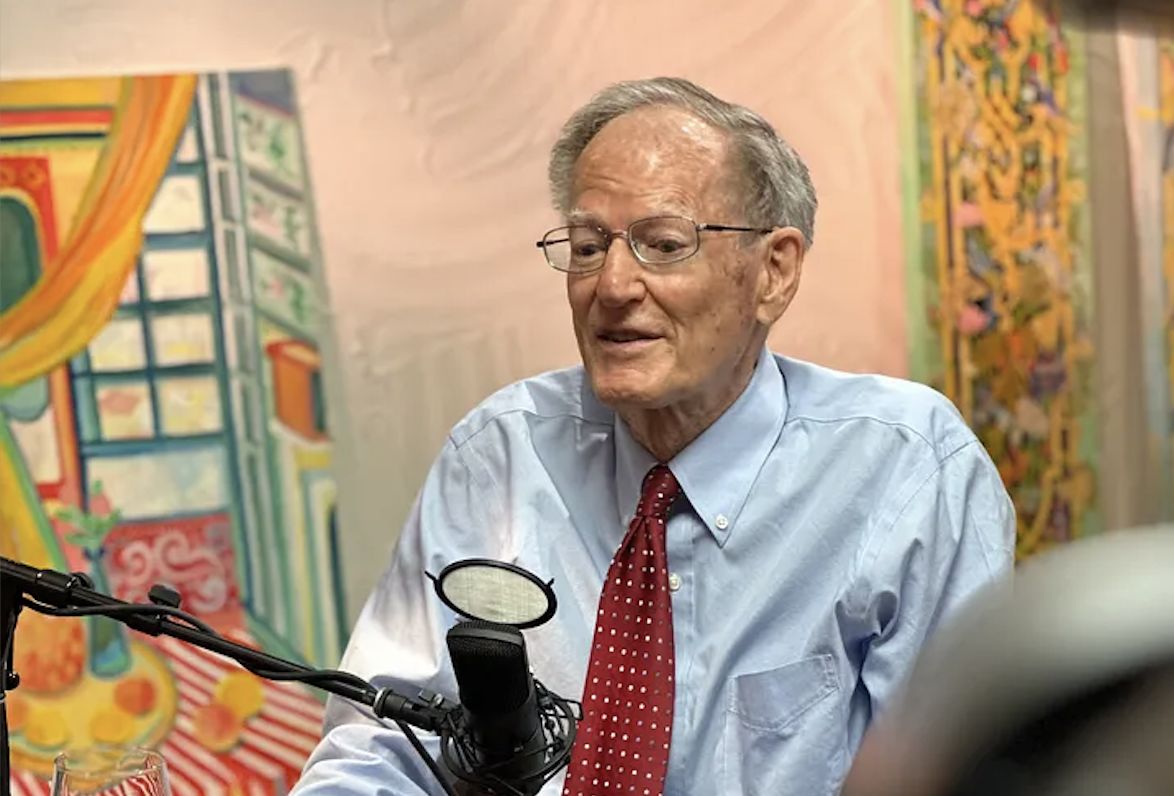

George Gilder Joins Bill and Cole Smead Live on A Book with Legs Podcast

From A Book with Legs Podcast: Live from the 2024 Smead Investor Oasis, venture capitalist George Gilder joins Bill and Cole Smead to discuss his latest work, “Life after Capitalism,” in which he redefines capitalism as a knowledge-based system. Gilder presents a vision of the future in which technological advances disrupt traditional capitalist structures, emphasizing innovation and knowledge over wealth accumulation. Listen here:

How Financial Regulators Have Become a (Progressive) Law Unto Themselves with Todd Zywicki

“Capitalism’s Promise: Essentially Infinite Resources and Human Flourishing” with George Gilder and John Tamny

Watch the episode here. I’m talking in this episode with the upbeat and visionary George Gilder, one of America’s leading economic and technological thinkers, and the author of the groundbreaking books, Wealth and Poverty, Knowledge and Power, The Scandal of Moneyand now: Life after Capitalism: The Meaning of Wealth, the Future of the Economy, and the Time Theory of Money Co-hosting with me is the equally upbeat and contrarian thinker John Tamny, founder of Parkview Institute, editor of RealClearMarkets and author of the recently published The Money Confusion: How Illiteracy About Currencies and Inflation Sets the Stage for a Crypto Revolution“ Life after Capitalism launches a new economic theory. A key theme of the book is that wealth is knowledge and that the difference Read More ›

“When ‘Free Trade’ Does More Harm Than Good” with Robert Lighthizer

Click here to watch the interview. For regular listeners, you know I like to take on complicated subjects, and try to make clear what’s at stake for all of us. Thanks for reading The Bill Walton Show! Subscribe for free to receive new posts and support my work. Pledge your support In this episode the Bill Walton Show we take a another deep dive into one of the most complicated and contentious areas of economic policy: International trade. International trade negotiations are incredibly complex multilevel games—there are negotiations not just with America’s trading partners, but with Congress, domestic constituencies, and rival factions within the executive branch. There are sharp – almost theological – differences in how trade policy ought Read More ›

Financial Regulation: Boring, or Terrifying? with Chris Iacovella and Norbert Michel

Watch the episode on YouTube. A slew of financial crises that stretch all the way back to the banking Panic of 1907 have been exploited to justify erecting a financial regulatory system that has vastly centralized and expanded federal power over our money. The irony is that these crises were largely caused, or at least exacerbated, by poorly designed government regulations. What we have now is an unholy alliance of regulators, mega banks and entrenched special interests who are the chief beneficiaries our system of opaque and complex financial regulation. Adding to this mix is the progressive Left who are now using our financial system to push its DEI and climate change agendas. Joining me on this episode to explore Read More ›